THE REAL FINANCIAL PLANNING EXPERIENCE

THE REALFINANCIAL PLANNINGEXPERIENCE

Strateon Intelligent Wealth is Different

Real financial planning is something most people will never get to experience. Buying investment products from a financial advisor at a broker-dealer isn't real financial planning. Getting generic stock market and investment advice from a financial advisor (or an AI advisor) isn't real financial planning either. You can get the same thing from CNBC and other publications. Working with a financial advisor who is paid on commission isn't real financial planning either, because they're getting paid to sell you a certain product, and ultimately you'll gain very little from those arrangements. You deserve more and better.

With Strateon Intelligent Wealth you'll get a financial planner that cares about you and your future and is always looking out for your best interest. With large firms, their goal is to sell you a product to reach a sales quota. With Strateon Intelligent Wealth, the goal is your success and your family's success. At Strateon Intelligent Wealth, your financial planner and investment advisor will take the time to learn about you so you get answers to the important questions you have and actually make progress toward achieving your goals.

See Your Financial Picture

Strateon Intelligent Wealth's advanced financial planning software is the core of your financial plan. With your free trial you'll get a brief overview of your current situation, including all the features below.

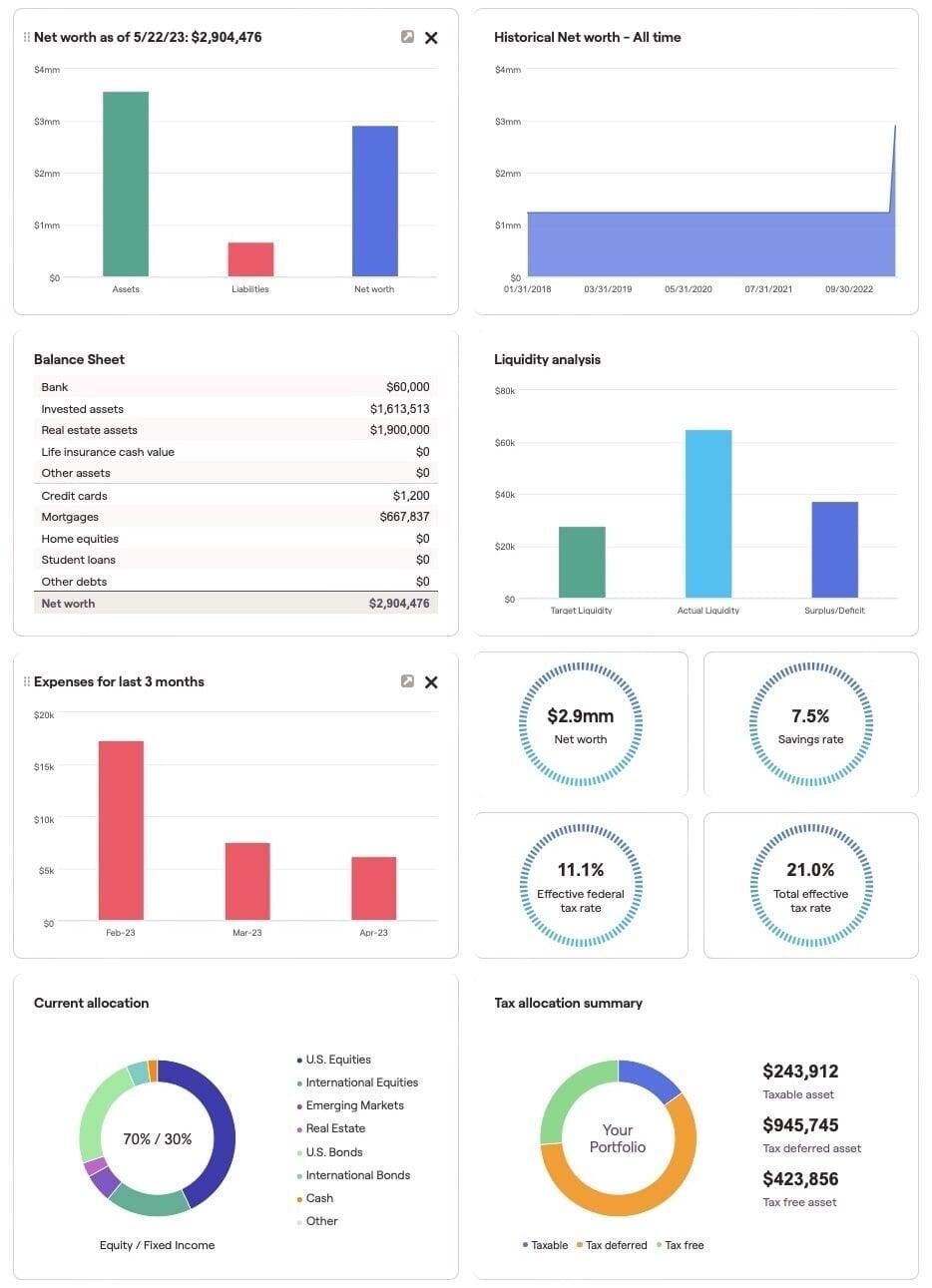

Your Financial Snapshot

With your financial snapshot you'll get a quick overview of your financial situation.

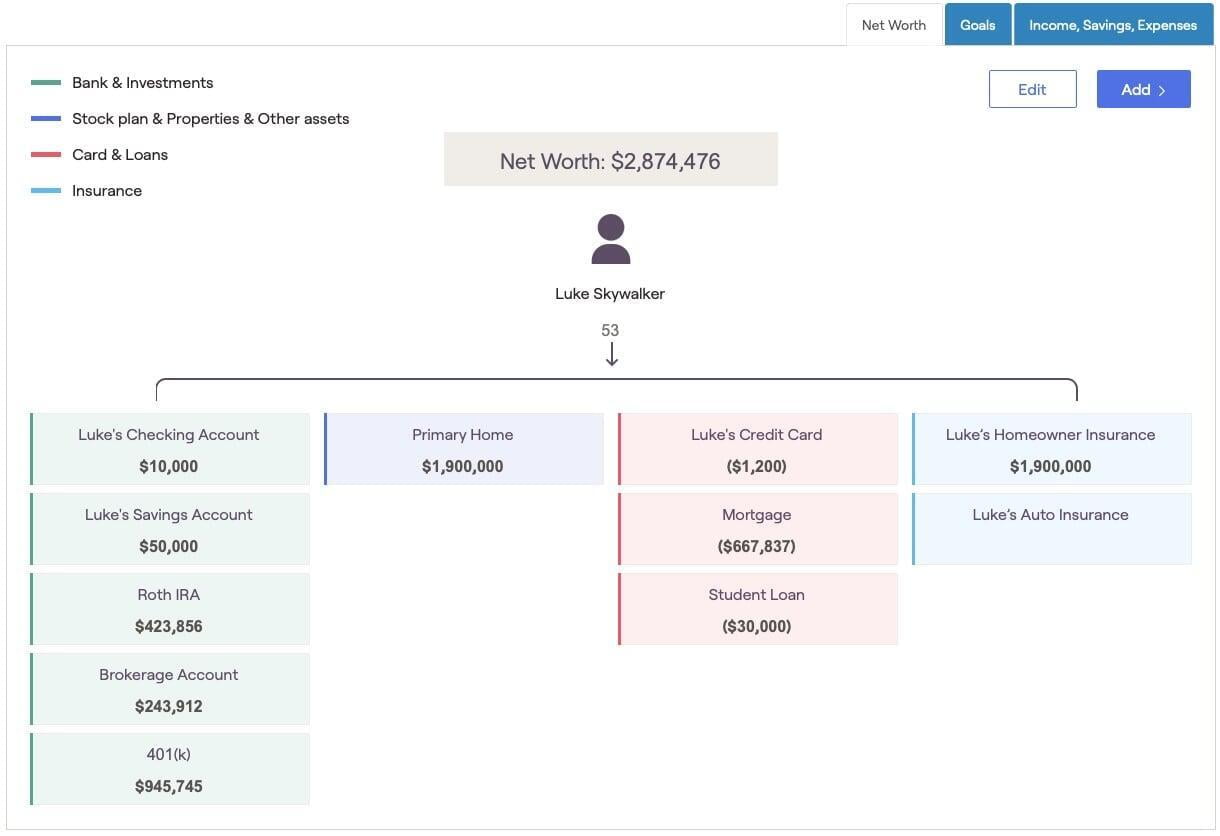

Net Worth – Assets, Liabilities, and the difference between them now and in the past

Balance Sheet – a breakdown of your assets and liabilities, totaling your net worth

Liquidity Analysis – What is your target liquidity (i.e. emergency fund) and how is your actual liquidity compared to your target? A surplus in liquidity means you can put more cash to work as investments or as spending cash, whereas a deficit means you need to add more to your emergency fund.

Last 3 Months Expenses – How are your expenses trending the last 3 months? You can also look a a variety of other time periods in the Budget module.

Quick gauges – At a glance, see your net worth, savings rate, and effective federal and total tax rates.

Investments – see a breakdown of all your investments by asset class among all of your combined investments accounts, from your 401(k), IRA, brokerage accounts, and more.

Tax allocation – Are your investments concentrated in accounts that you'll eventually pay taxes on? Are your savings and investments placed where they will efficiently be taxed?

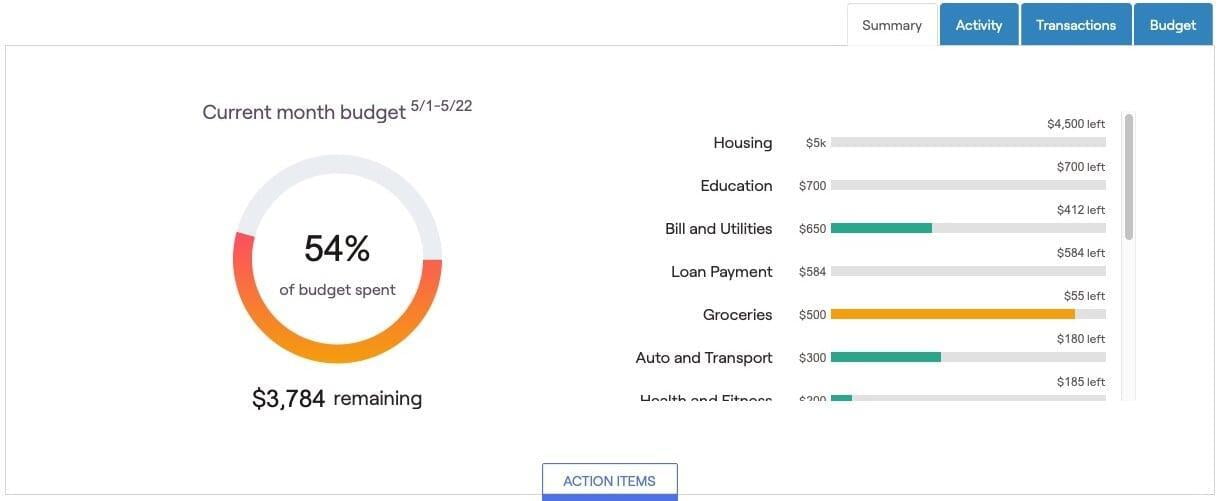

Budget

Create a budget of all your expenses and monitor your spending throughout each month. Add any and all of your spending categories, and adjust transactions as needed. This feature requires connecting your accounts within RightCapital.

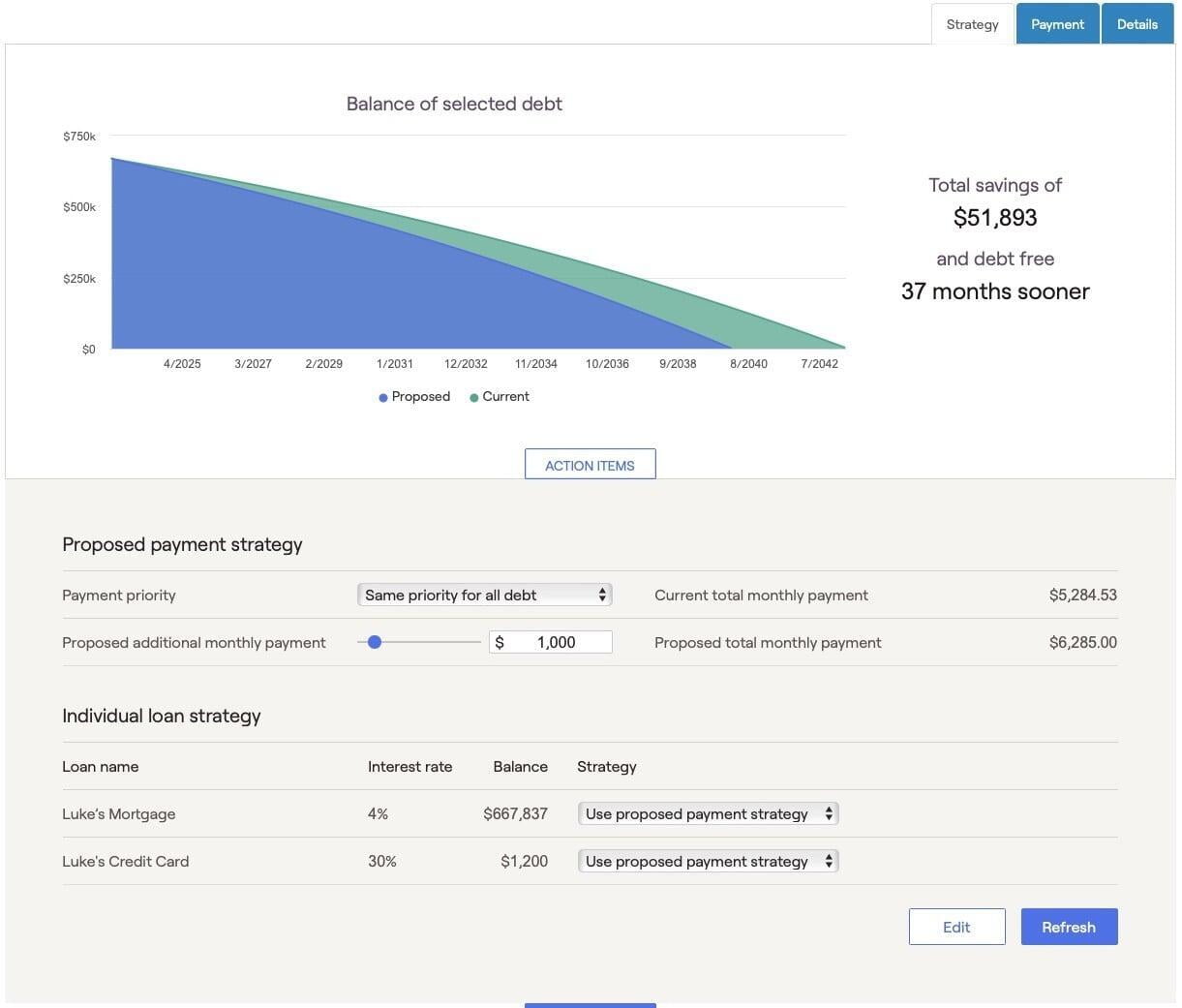

Debt Management

See when you're expected to pay off all your debt with your current payments, and estimate different payoff dates with different payment amounts. See how much money you can save in interest payments by paying off your debt earlier. Look ahead and see how much your future debt payments will be.

Risk Assessment

See how the risk level of your current portfolio compares to your risk tolerance and the risk level of the target portfolio.

Take a risk assessment and see what your personal risk tolerance score is. Previous assessments are saved so you can see how your risk tolerance changes over time.

See the upside and downside potential of your current and target portfolios compared to other common investment strategies.

See the risk level score of each of your investment accounts side-by-side with the allocation and volatility.

Equity Style

See which style of equities you're invested in. Are your investments tilting heavily a particular valuation or market cap? The style of your investments could be an indication of potential performance and risk.

Equity Sectors

See which equity sectors you're invested in. Are your investments tilting heavily in one or more sectors, and under-invested in others? Doing so could increase risk.

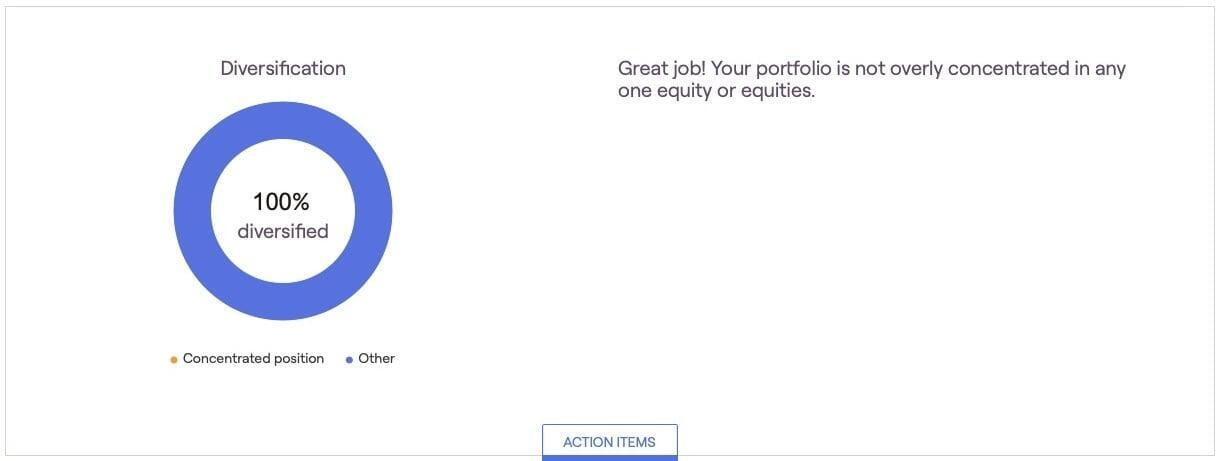

Investment Concentration

If your investments are concentrated in one or more asset classes, sectors, or style of investments, then that could mean you're not properly diversified. An investment portfolio that's not properly diversified could introduce additional risk that could bring about greater losses in a volatile market.

And There's More!

After you receive the overview of your financial picture, we'll meet to give you a preview of the full Real Financial Planning Experience. With Strateon Intelligent Wealth's Ongoing Comprehensive Financial Planning + Investment Advice service every aspect of your financial life is covered. Here are just some of the additional things you'll gain from real financial planning with Strateon Intelligent Wealth.

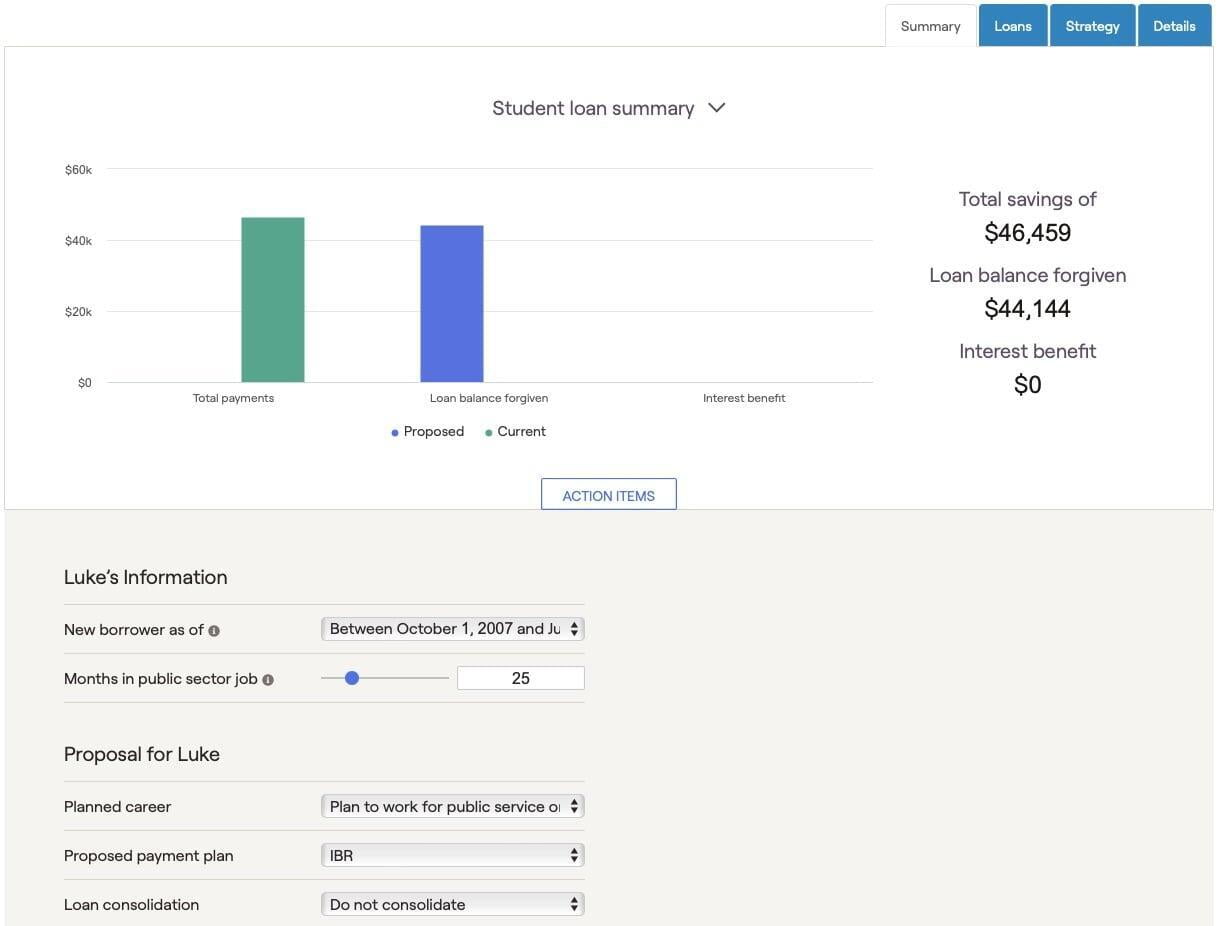

Loan Repayment Strategies

Whether it's a mortgage, student loan, or car loan your financial plan will include debt payoff strategies designed to get you out of debt sooner and save you money on interest payments, while maintaining efficiency of the use of your money with continued savings and investments so you can still reach all of your other goals.

Investment Strategies

With your goals (and your risk tolerance in mind) investment strategies are developed to accomplish the goals that you have set out to achieve throughout your life. Quickly see comparisons of different strategies and how they affect your short-term and long-term goals.

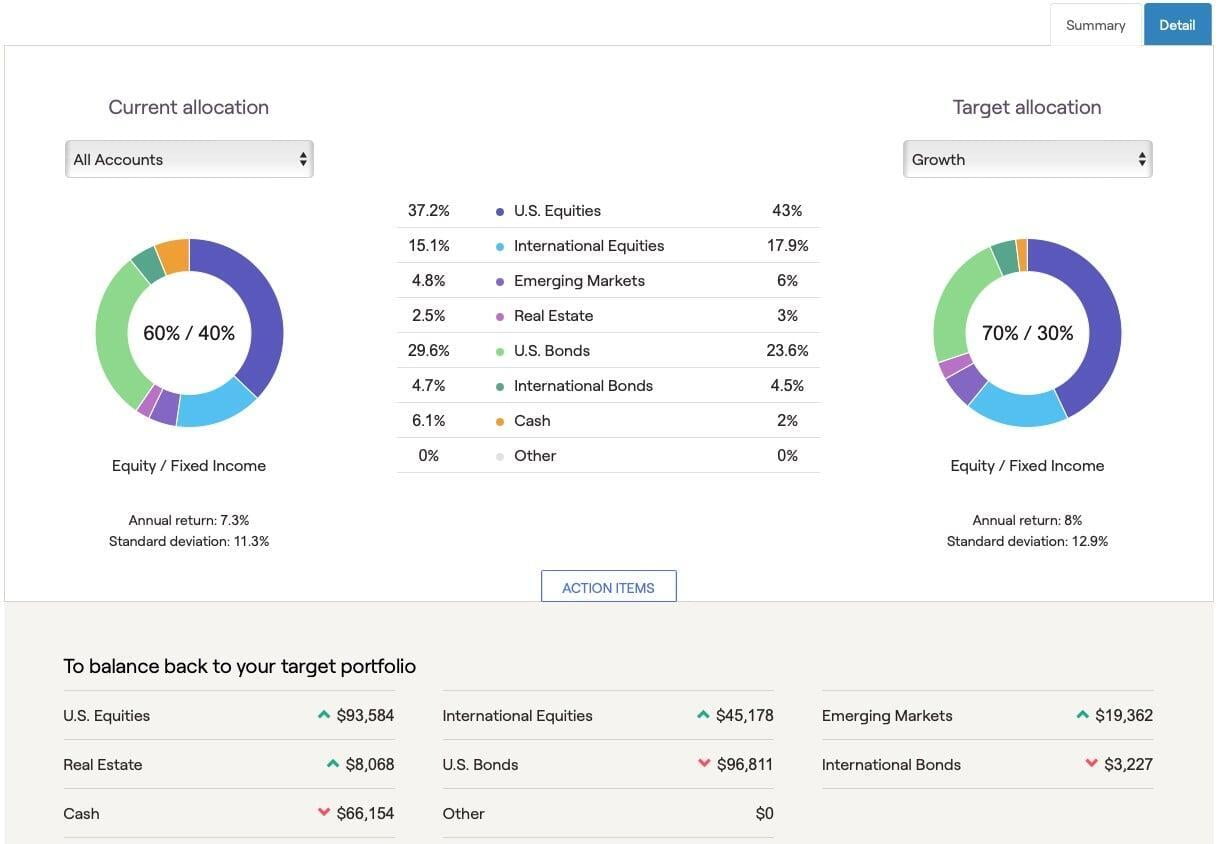

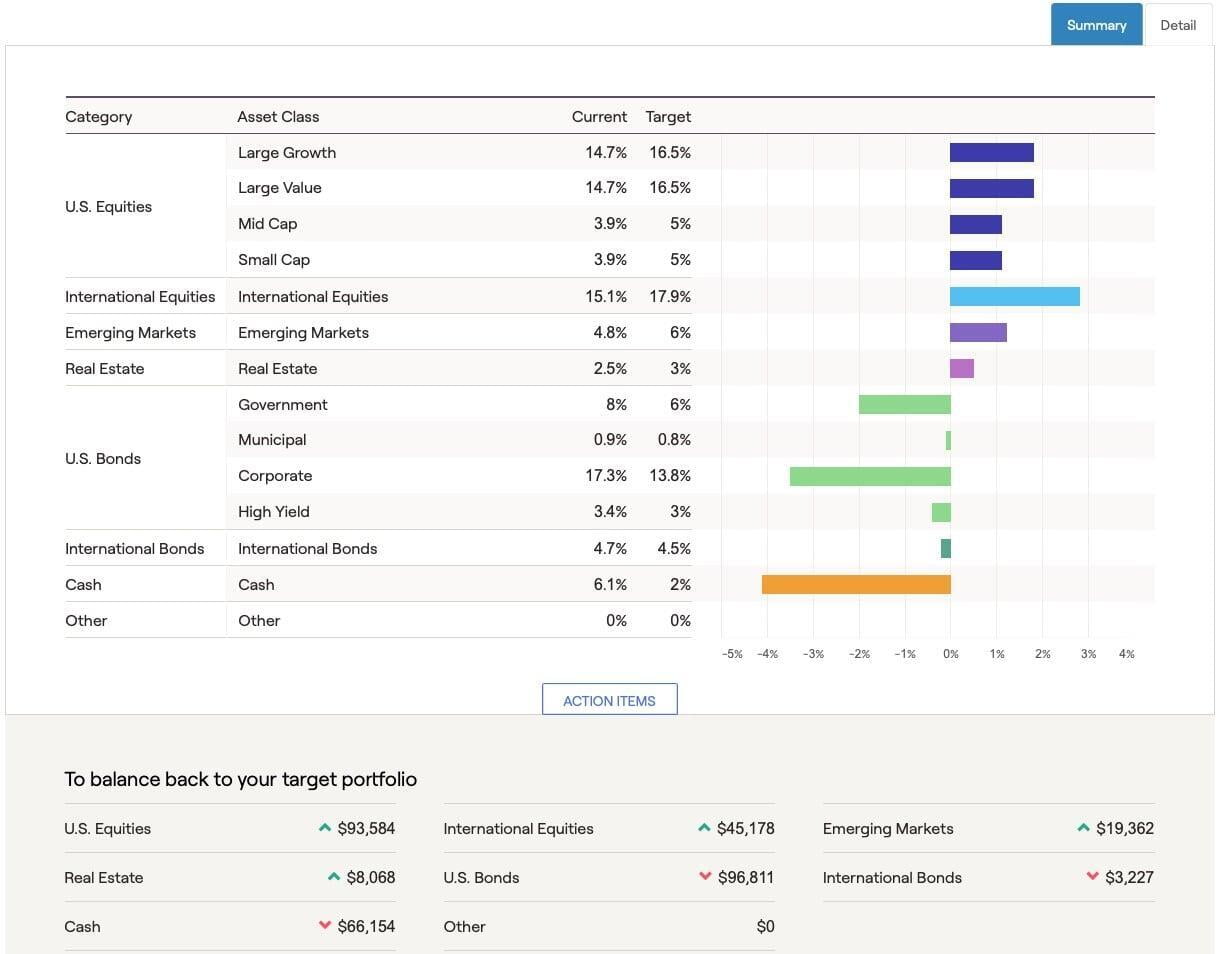

Investment Allocation & Rebalancing

The allocation (the mix) of your investments in your portfolio changes over time as some assets perform differently than others. You may have started with and aimed for 70% equities and 30% fixed income, but now you're at 60% equities and 40% fixed income. See how your portfolio deviates from your target allocation and also how the performance and risk expectations are different.

Rebalancing a portfolio is the process of selling some assets to purchase others to get the portfolio to its target allocation. For example, you may have a target of 70% equities and 30% fixed income, but you're at 60% equities and 40% fixed income. See what exactly needs to change in your investments to get to your target investment allocation.

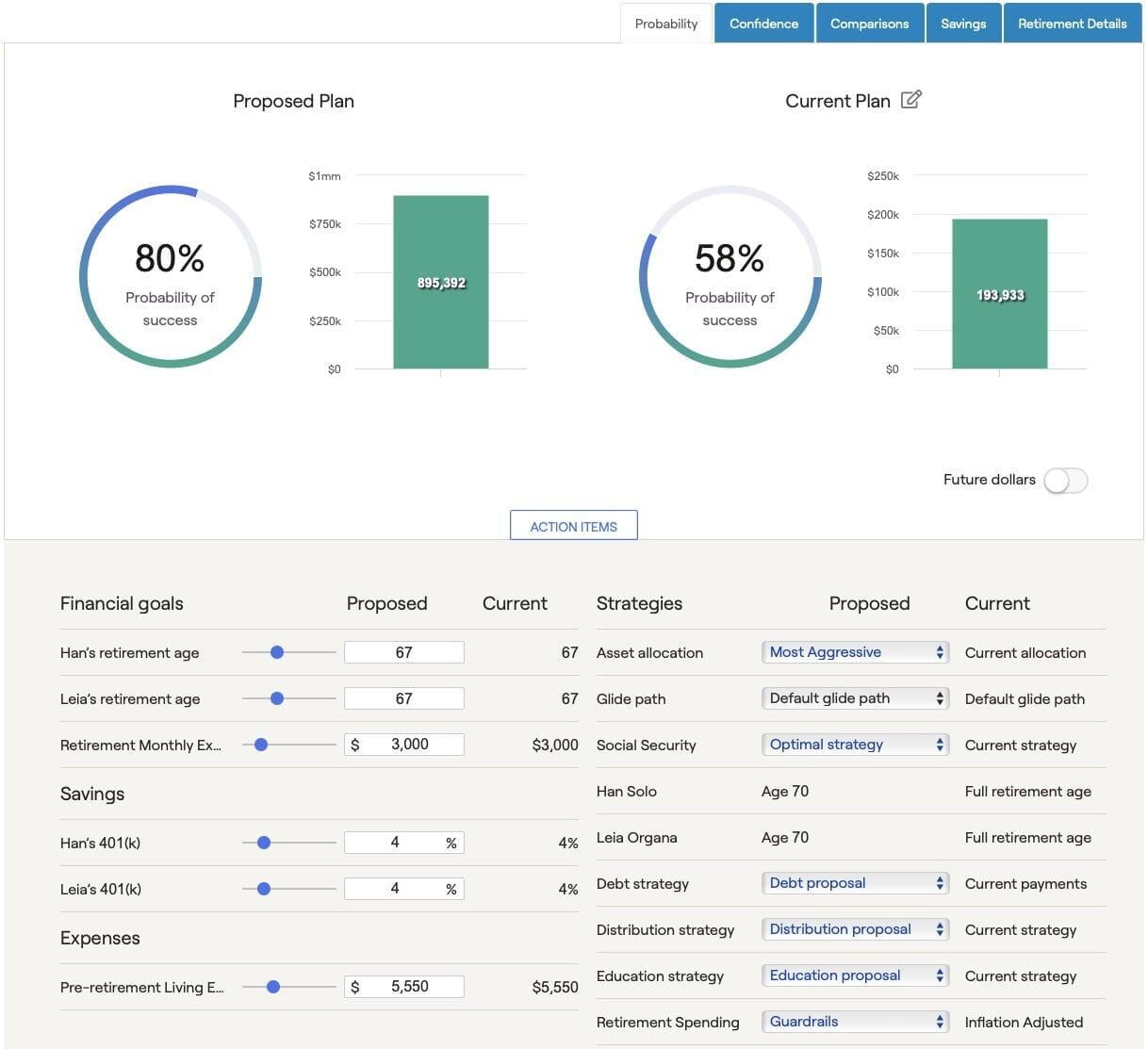

Retirement Success Probability

Using analysis and performance expectations, your financial plan is able to provide a probability of success that you will achieve all of the goals you've currently set throughout your life. See a comparison of your current trajectory and what might be expected with the recommendations in your financial plan. Together we can make adjustments and changes to your plan as you progress through your life in order to keep you on track to financial prosperity in retirement.

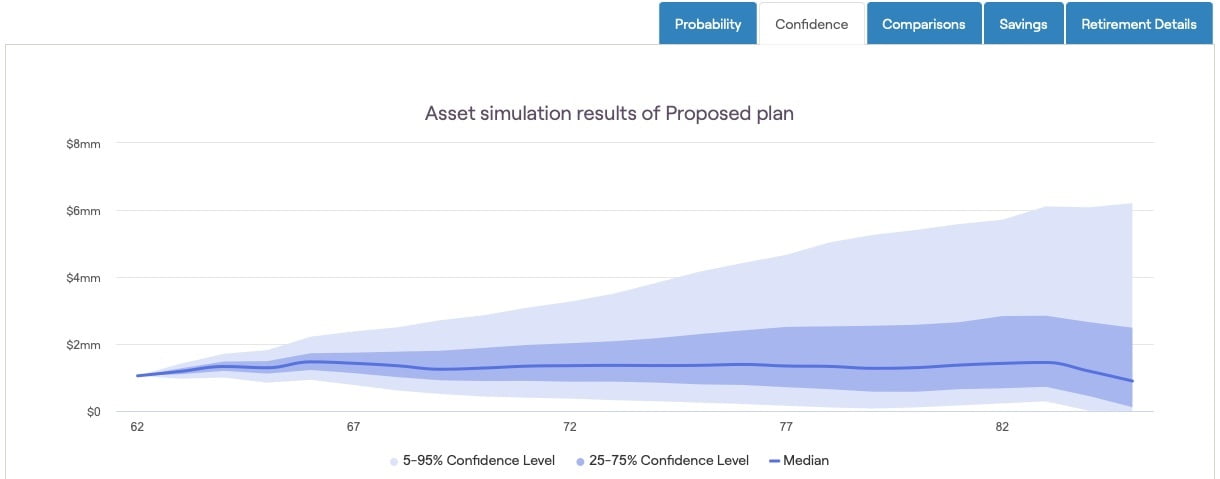

Retirement Asset Simulation

Of course, the probability of successfully achieving all your goals isn't a definite number. You'll also be able to see a range of possibilities throughout your life.

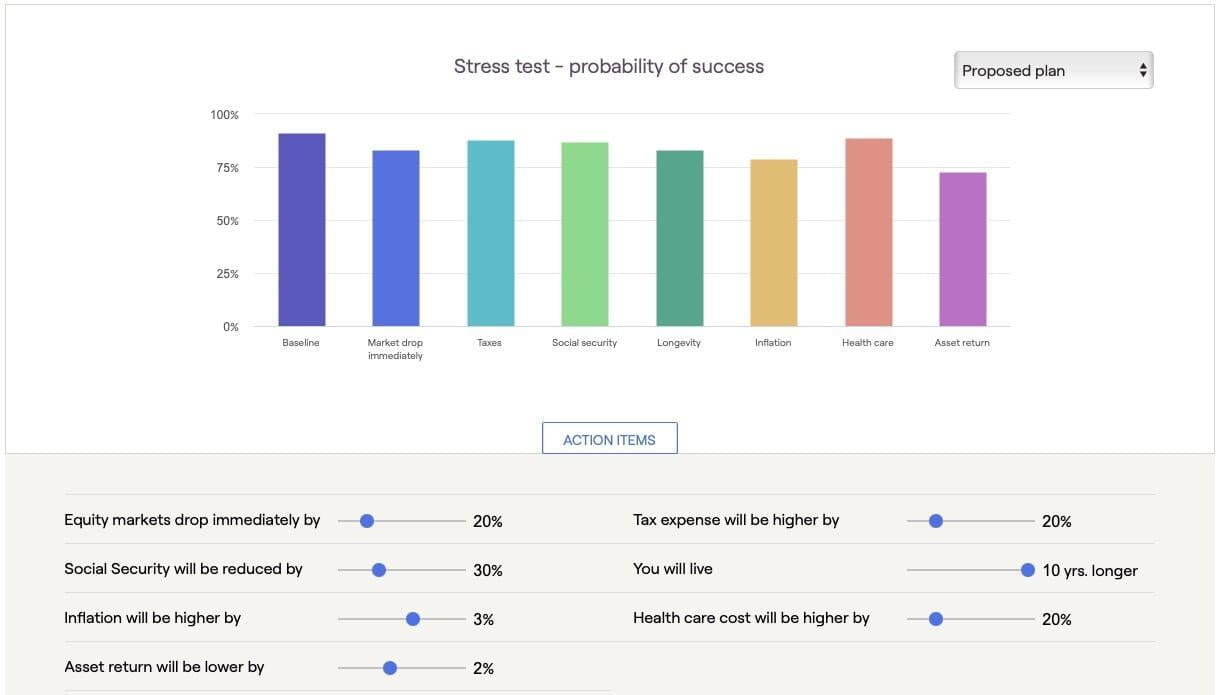

Retirement Success Probability Stress Test

Things happen, the economy changes, and domestic and global events occur that affects markets. See the results of stress tests that are run on your financial plan to get an idea of how you'll fare under various scenarios.

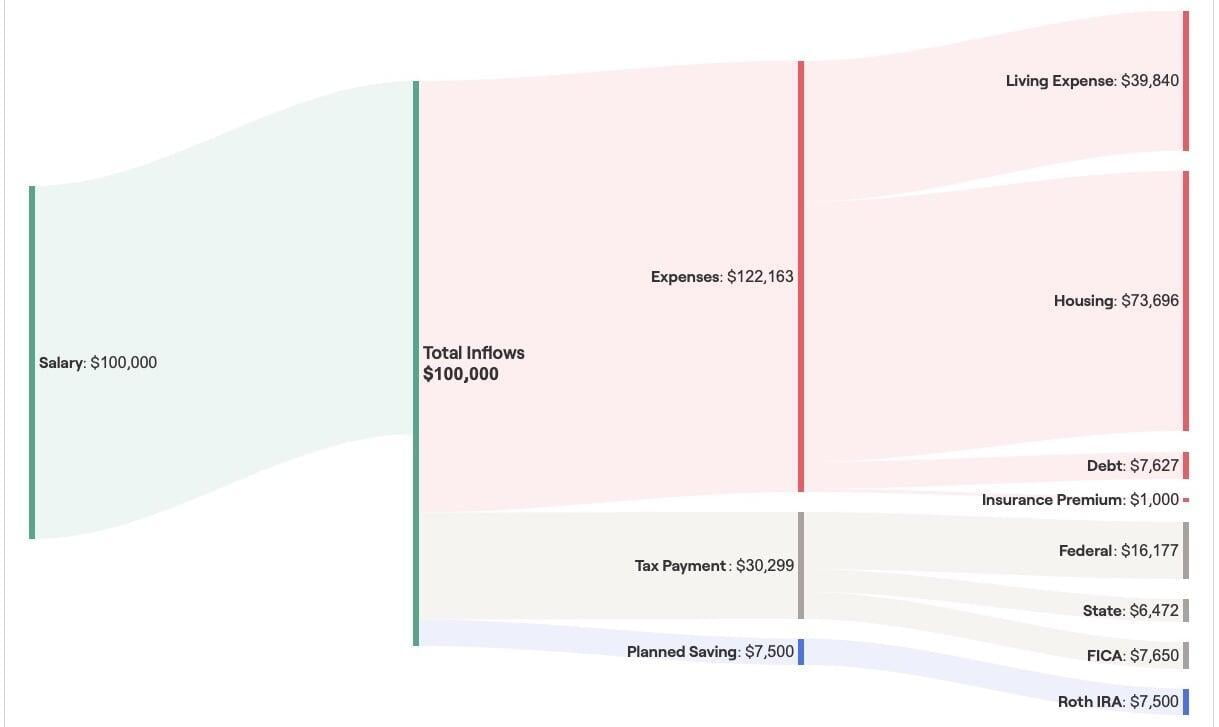

Visualized Cash Flow

See where all your money is coming from and where it's going in a quick, simple cash flow map.

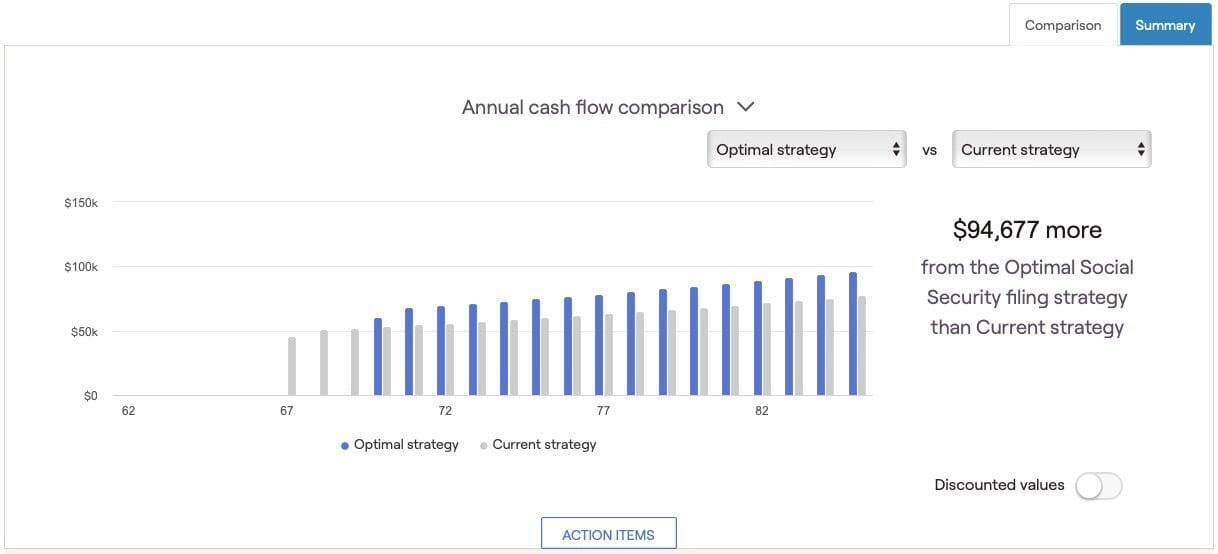

Social Security Optimization

Should you begin receiving your Social Security benefits at age 62? 67? 70? With your comprehensive financial plan you'll find out the optimal age to begin receiving Social Security so you can be sure you're taking full advantage of the benefits you worked so hard (and actually paid) for over the years.

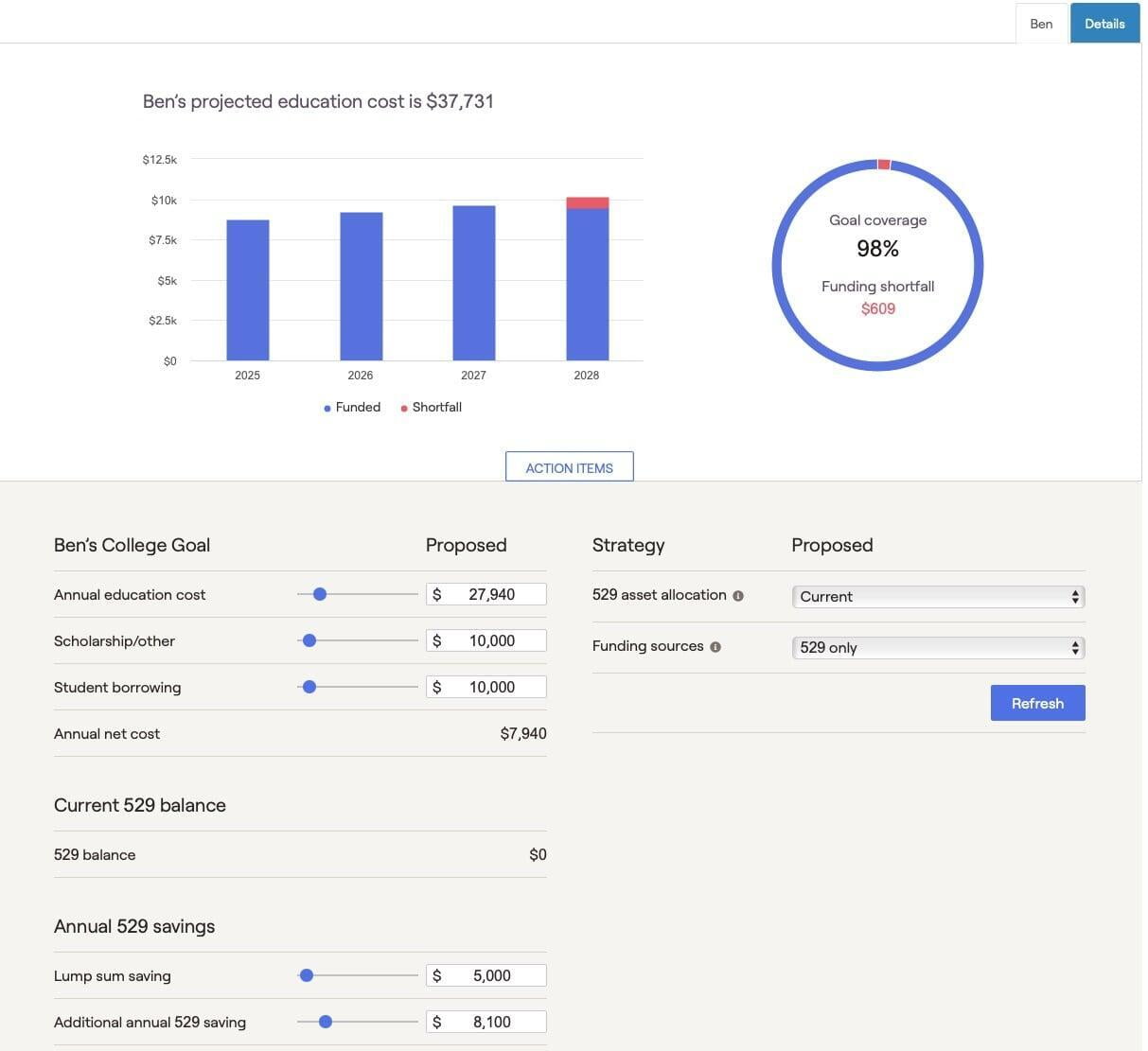

Education Cost Planning

College education is one of the most difficult things to plan and save for. Your financial plan will show you how much to save and invest, and where, so that you're ready to send your children to college when the time comes.

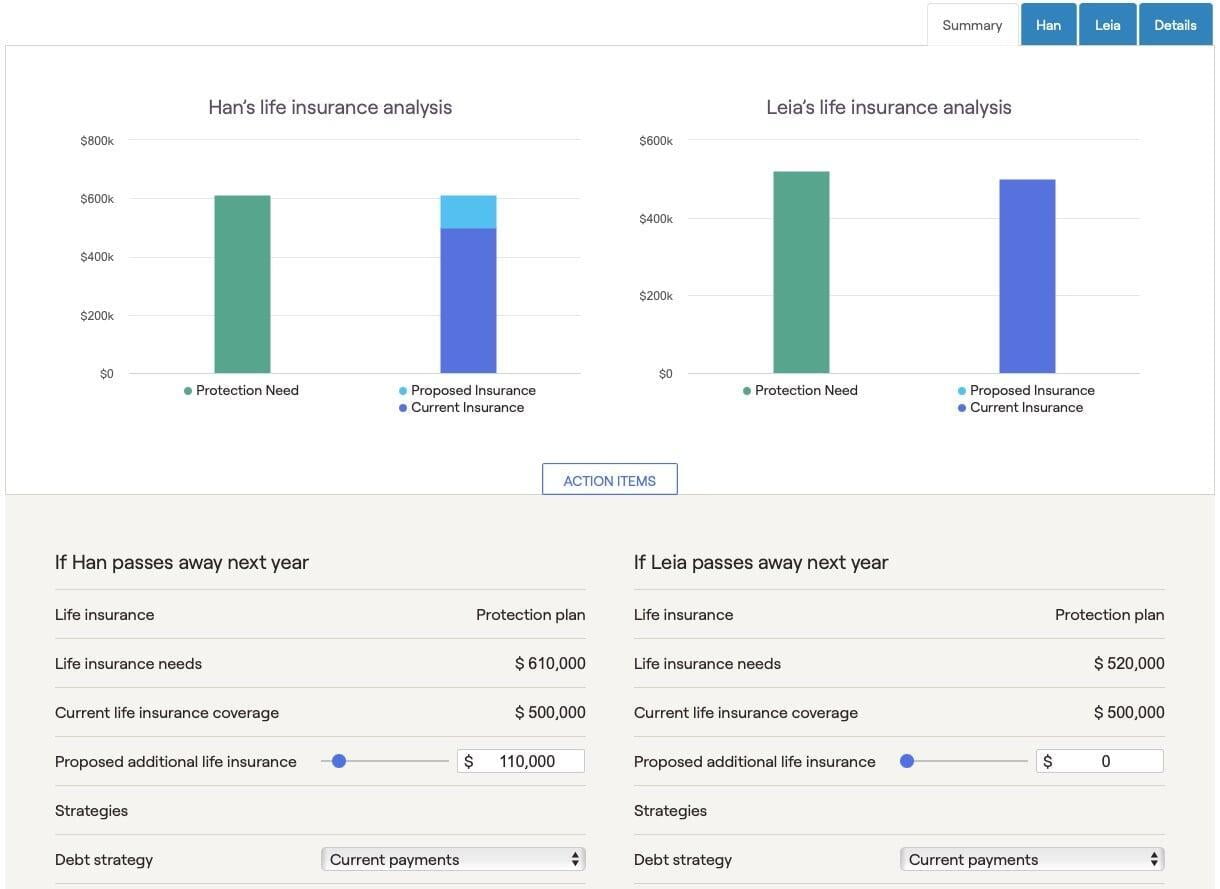

Insurance Review & Analysis

By looking at your current financial situation, including your assets, debts, and future goals, your financial plan will be able to tell you if you should have various kinds of insurance (including life, disability, long-term care, property and casualty, and umbrella) and how much coverage is ideal.

See Your Financial Life Mapped Out

See a simple, clean overview of your financial life, including all your assets, liabilities, and insurance.

Tax Planning

Your tax bracket changes throughout your life. With tax planning in your comprehensive financial plan you can save more money for the long-term by moving tax payments from the future to the present (or even further in the future) to reduce your overall lifetime tax.

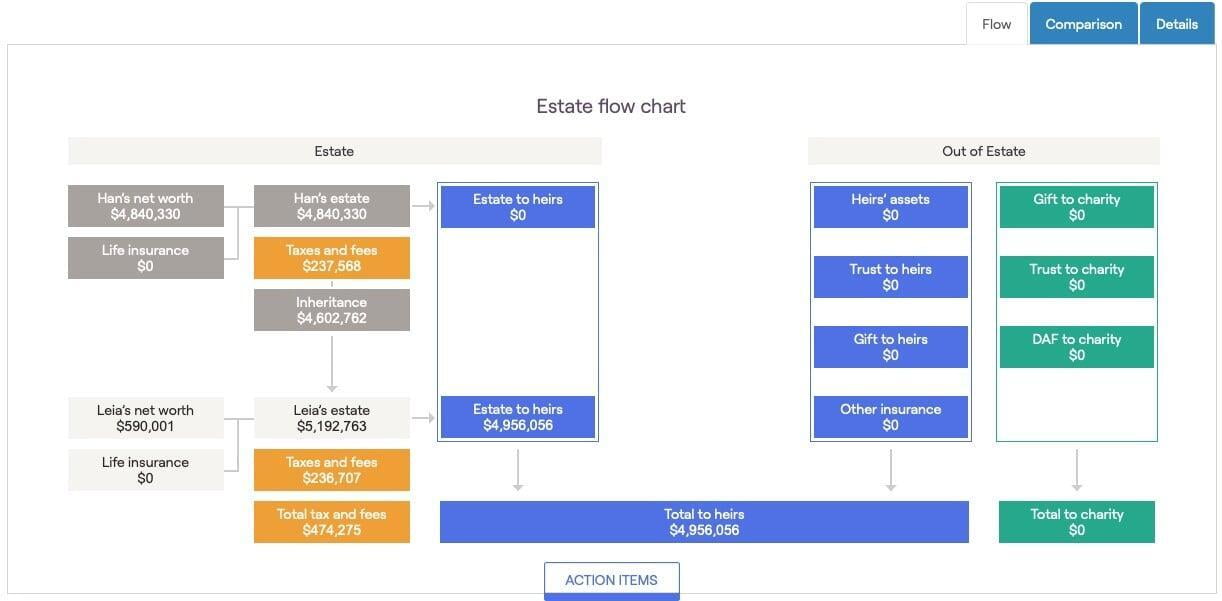

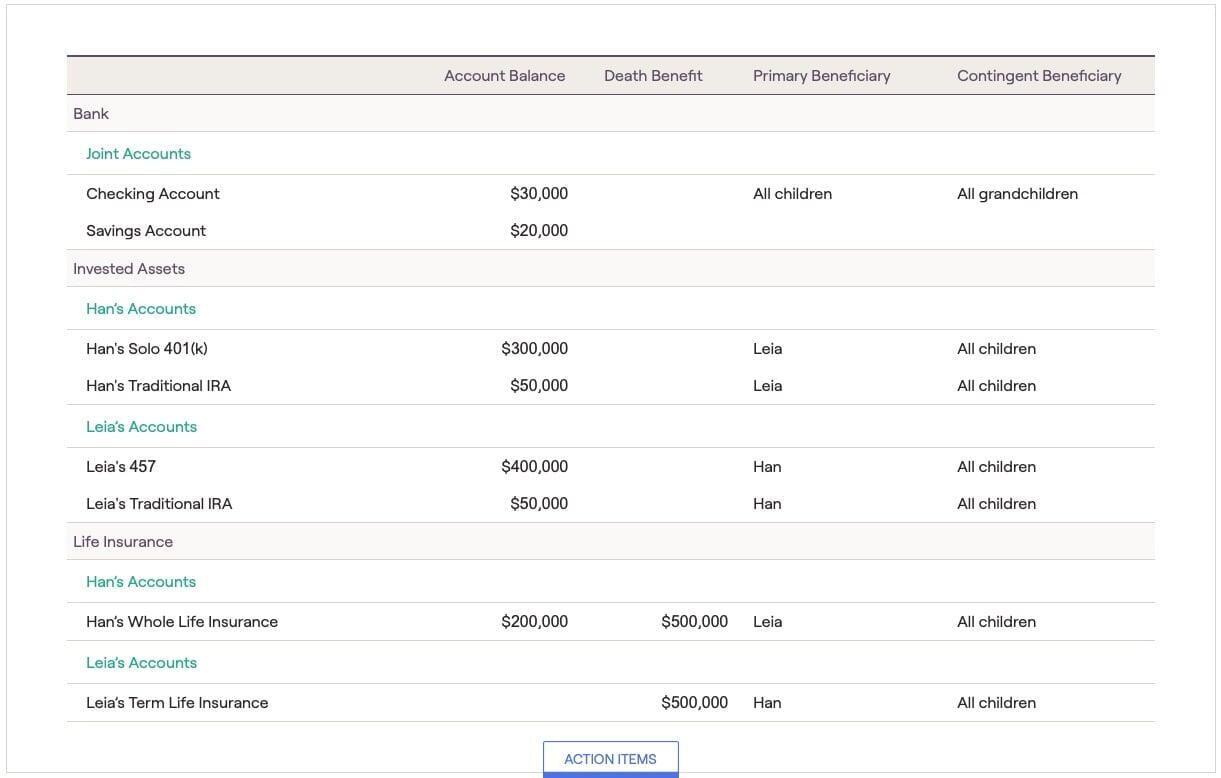

Estate Flow Chart

Estate planning can be one of the most difficult areas of financial planning to deal with. Your comprehensive financial plan will make this easier by helping you determine where you want your assets to go.

Estate Planning Beneficiaries Overview

One of the biggest dangers with estate planning is forgetting to assign beneficiaries to accounts and assets. Your comprehensive financial plan will let you enter your beneficiaries you have assigned to your accounts so you can be sure you've set them how you want them.

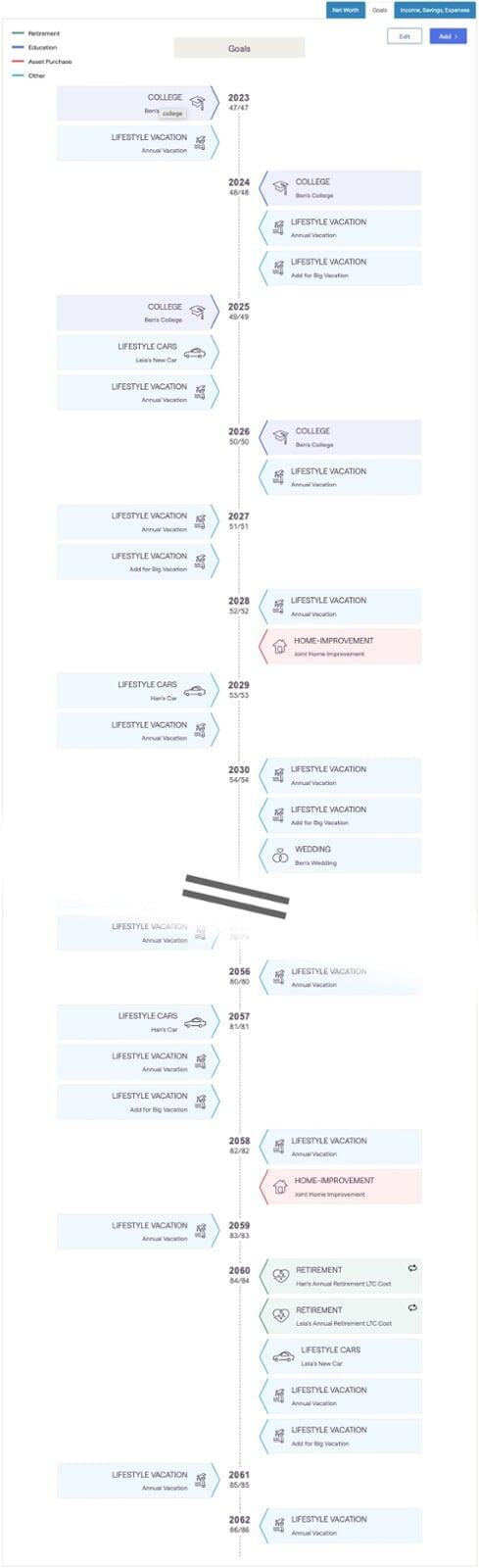

Goal Visualization

See all your goals in a clean, easy-to-read timeline. See your future before your eyes and know what you have coming up ahead of you.

Why Wait?

Start Your Journey to Financial Freedom Today!

Start Your Journey to

Financial Freedom Today!

Experience Real Financial Planning Now!

Experience RealFinancial Planning Now!

Don't put off planning for your financial future another minute! Experiencing real financial planning is easier than you think. You can get started now with a taste of real financial planning from Strateon Intelligent Wealth. There's NO COST and NO OBLIGATION for a FREE 7-DAY TRIAL, complimentary Real Financial Planning Experience meeting, and review of your current financial situation. All you have to do is sign-up and start entering your information, step-by-step. Of course, if you need help, you can be guided through each step. Once you follow these steps, the rest is done by your financial planner.

There is NO COST and NO OBLIGATION.

There is NO COST

and NO OBLIGATION.

Get started right now by agreeing to the terms of use and clicking on the link below to be taken to the financial planning software, RightCapital. Once there, create your free RightCapital account. You'll need a valid email address, and it's recommended to set up 2-factor authentication.

- Please schedule a meeting as soon as possible so we can discuss your financial situation and what you're looking for in a financial planner.

- Access is limited to 7 days, unless you become a client.

- Access during the trial will be limited, but will be enough for you to get an idea of where you stand now with your financial situation.

- Some modules or sections of modules will not appear.

- You will not be provided personalized or customized financial advice or recommendations unless you become a client.

- You will not receive a report or full financial plan unless you become a client.

- Your information and anything you say about your financial situation will be kept private.

- Strateon Intelligent Wealth will not sell your personal information, including name, email address, and phone number to anyone.

- You will be subscribed to the Strateon Intelligent Wealth Insights Newsletter. You can unsubscribe at any time.

Terms of Use

Add Family Information

First, you'll enter your family profile. If there's no co-client (i.e. spouse), you can delete the Co-Client card. Then add children and other family members (i.e. other dependents) that will affect your financial plan.

Add Income Information

Next, you'll enter your income information. This is the salary you receive from your employer, plus any other income you receive (whether it's taxable or not) such as unemployment, alimony, child support, non-employee income, etc. You can also update the Social Security cards to change the age you want to start receiving benefits. This is typically the age you'd like to retire. Don't over-think it, and don't worry, we'll come back to this later.

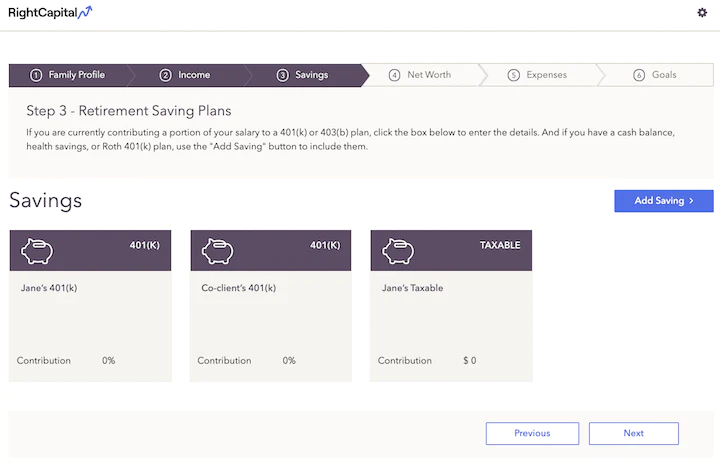

Add Savings Information

Add any savings you have throughout the year. If you have a 401(k) or other employer-sponsored retirement plan, update/add the appropriate card with your contribution information. If you contribute to an IRA, Roth IRA, or any other retirement plan or account, add the appropriate card with the information as well.

Add Assets

Now is the time to add your assets. Your assets include your checking and savings accounts, investment accounts, retirement accounts, etc. They also include your home, rental properties, vacation home, vehicles, or other substantial property of value. For accounts, there are 2 ways to do add your assets...

Option 1: Connect your accounts by signing into them through RightCapital. It is a secure connection, is read only, and no one will have any access to login to or manipulate your accounts besides you. The advantage with this option is that your financial plan will always have updated information for your accounts with the correct cash balances and investment holdings. The disadvantage is that sometimes the connection stops working, so you'll occasionally have to reconnect. Connecting your accounts is required to use the Bedget feature of RightCapital. You can see the process of connecting your accounts in the animation below.

Option 2: Manually add each of your accounts. This will require you to enter your account balances and investment account holdings manually and update them manually to keep your financial plan up-to-date. That can be pretty tedious, so the recommendation is to connect your accounts.

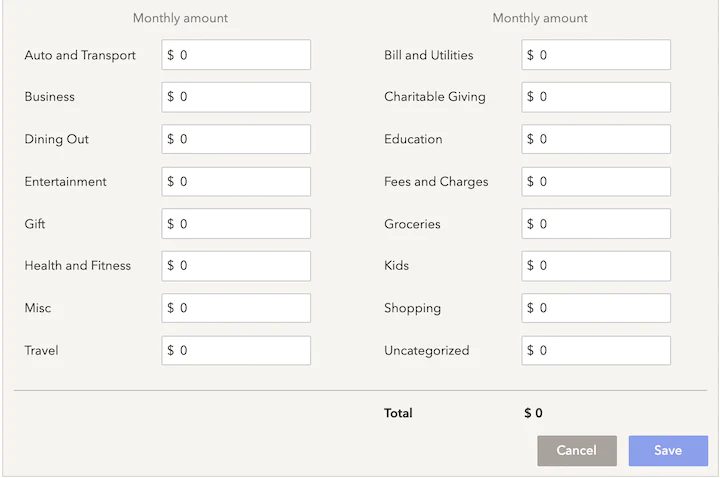

Add Expenses

There are 2 ways to add your expenses. The simple way is to enter a monthly total of your expenses. Although this will get you some initial results in your financial plan, it won't let you create a budget. The more detailed way, where you enter the monthly expense for each category, will give you more insight into your spending and enable you to use the Budget feature.

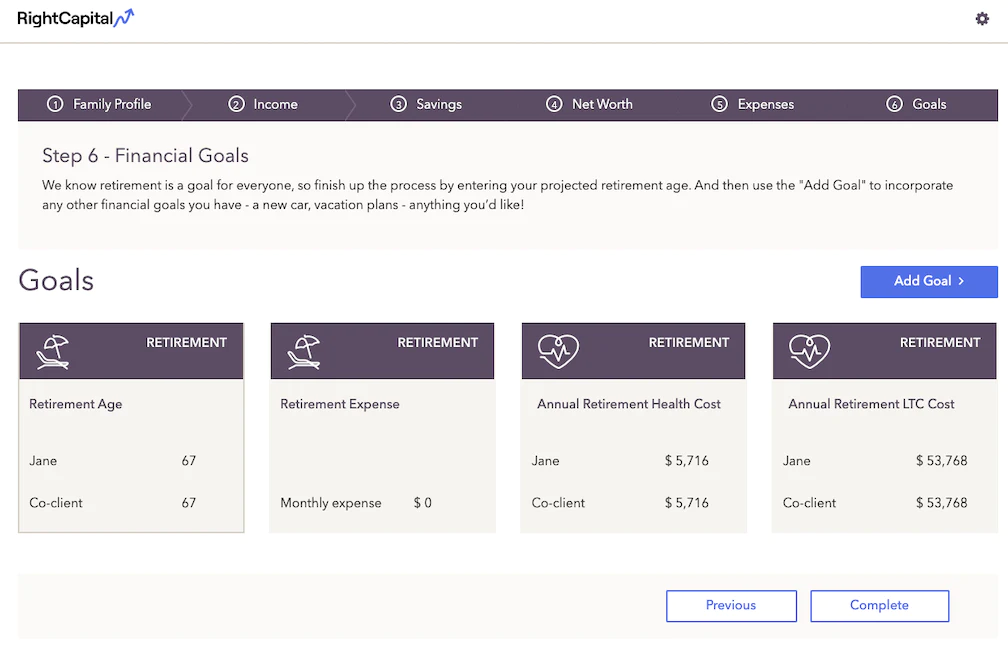

Add Your Goals

Finally, the last step in entering your information is to add some goals. Goals can include a variety of things that you want to accomplish financially, including your desired retirement age, a home purchase, college education for a child, wedding for yourself or a child, vacations, new car purchase, home improvement, a new computer, or anything else you can think of.

It's Time to Meet With Your Financial Planner

Now that you've entered all the required information you can take a look at your snapshot, net worth, assets, liabilities, debt management, investments, and budget. There's a lot more to real comprehensive financial planning, though, and the next step is to see what that is. Schedule a meeting below to get the full Real Financial Planning Experience.

Use the scheduler below to schedule a time that works best for you. If you can't find a time that works, please reach out to me directly and we'll find a time that does.

Need Help or Guidance with Logging In or Setting Up?

If you still have questions, or if you would prefer having someone step you through the process, let's schedule a meeting. Use the scheduler below to schedule a time that works best for you. If you can't find a time that works, please reach out to me directly and we'll find a time that does.